It quotes Thomas Astebro's article, "The Return to Independent Invention: Evidence of Unrealistic Optimism, Risk Seeking or Skewness Loving?"

Abstract: Examining a sample of 1,091 inventions I investigate the magnitude and distribution of the pretax internal rate of return (IRR) to inventive activity. The average IRR on a portfolio investment in these inventions is 11.4%. This is higher than the risk–free rate but lower than the long–run return on high–risk securities and the long–run return on early–stage venture capital funds. The portfolio IRR is significantly higher, for some ex ante identifiable classes of inventions. The distribution of return is skew: only between 7–9% reach the market. Of the 75 inventions that did, six realised returns above 1400%, 60% obtained negative returns and the median was negative.

It also cites sessions held at the Annual Meeting of the Allied Social Science Associations in Boston on January 7, 2006

William Baumol Special Sessions on Entrepreneurship, Innovation and Growth

The session included the following papers that are online:

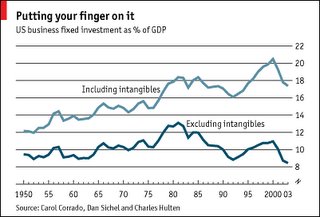

WILLIAM BAUMOL, New York University—Entrepreneurship and Invention: Toward Their Microeconomic Value TheoryLast week the column focused on investment in intangibles, and the effect on measurement of economic growth of alternative ways of estimating such investment.

EDWARD LAZEAR, Stanford University—Leadership and Entrepreneurs: Where They Produce the Most Value

EDMUND PHELPS, Columbia University—Further Steps to a Theory of Innovation and Growth—On the Path Begun by Knight, Hayek and Polanyí

CARL SCHRAMM, Kauffman Foundation—Entrepreneurial Capitalism and the End of Bureaucracy: Reforming the Mutual Dialogue of Risk Aversion

DAVID AUDRETSCH and MAX KEILBACH, Max Planck Institute of Economics—Entrepreneurship Capital -- Determinants and Impact on Regional Economic Performance

YING LOWREY, U.S. Small Business Administration—An Examination of Entrepreneurial Effort

STEVEN KAPLAN, BERK SENSOY, and PER STROMBERG, University of Chicago—What Are Firms? Evolution from Birth to Public Companies

PAUL GOMERS, ANNA KOVNER, JOSHUA LERNER, and DAVID SCHARFSTEIN, Harvard University—Venture Capital Investment Cycles: The Impact of Public Markets

That column also linked to two papers that I thought interesting:

* “Intangible Capital and Economic Growth”, By Carol A. Corrado, Charles R. Hulten and Daniel E. Sichel, NBER working paper no 11948, January 2006.

ABSTRACT: Published macroeconomic data traditionally exclude most intangible investment from measured GDP. This situation is beginning to change, but our estimates suggest that as much as $800 billion is still excluded from U.S. published data (as of 2003), and that this leads to the exclusion of more than $3 trillion of business intangible capital stock. To assess the importance of this omission, we add capital to the standard sources-of-growth framework used by the BLS, and find that the inclusion of our list of intangible assets makes a significant difference in the observed patterns of U.S. economic growth. The rate of change of output per worker increases more rapidly when intangibles are counted as capital, and capital deepening becomes the unambiguously dominant source of growth in labor productivity. The role of multifactor productivity is correspondingly diminished, and labor's income share is found to have decreased significantly over the last 50 years.* “Measuring Capital and Technology: An Expanded Framework”, by Carol Corrado, Charles Hulten, and Daniel Sichel, Federal Reserve, August 2004:

ABSTRACT: Business outlays on intangible assets are usually expensed in economic and financial accounts. Following Hulten (1979), this paper develops an intertemporal framework for measuring capital in which consumer utility maximization governs the expenditures that are current consumption versus those that are capital investment. This framework suggests that any business outlay that is intended to increase future rather than current consumption should be treated as capital investment. Applying this principle to newly developed estimates of business spending on intangibles, we find that, by about the mid-1990s, business investment in intangible capital was as large as business investment in traditional, tangible capital. Relative to official measures, our framework portrays the U.S. economy as having had higher gross private saving and, under plausible assumptions, fractionally higher average annual rates of change in real output and labor productivity from 1995 to 2002.As countries mover from industrial to knowledge economies, both entrepreneurship (especially inventive entrepreneurship) and investment in intangibles assume greater importance. Without the economists inputs, represented by reports such as those linked above, policy makers will be hard pressed to develop appropriate policies to promote the knowledge society.

No comments:

Post a Comment