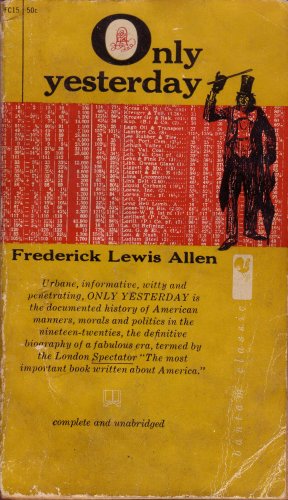

I have been reading Only Yesterday: An Informal History of the 1920's by Frederick Lewis Allen. First published in 1932, it is a wonderfully readable history of the decade. One chapter deals with the economic boom of during the Coolidge presidency. Allen attributes the boom to things like the development of advertising and consumer credit, and these are no doubt important. The analysis however neglects technological advances and innovation.

Of course a part of the business success was probably due to the pent up demand for goods and services developed during World War I. Such a pent up demand is thought to have stimulated the post World War II economy. On the other hand, U.S. involvement in World War I was less than that in World War II, and the Coolidge years were well after the war. So too, the destruction of the productive capacities of European economies during the war led to advantages to the U.S. industries in the post war years.

I would point out the importance of electrification and the internal combustion engine. In both cases it took a long time to develop the technological system and infrastructure to fully take advantage of the technologies (which had been first developed in the 19th century). By the 1920s they were transforming the production and distribution of goods. In the process they dramatically increased productivity.

Fewer workers were needed to produce the goods and services that had already been available on the market, but new products were invented to create new demands -- electric toasters, washers, air conditioners, and stoves not to mention electrical machines for manufacturing. Automobiles and trucks became more common and more elaborate.

The result was a beneficial cycle in which more productivity led to more income to buy more products; more demand led to more investment in productive capacity, which led to further increases in production and productivity. Growth in consumer credit and advertising helped to fuel the cycle.

Of course, lacking adequate government control of the system, the process eventually lead to too much debt and a bubble in stock prices. The resulting crash led in turn to the Great Depression.

No comments:

Post a Comment