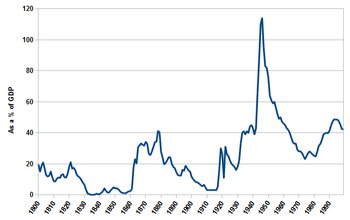

Ratio of Federal Debt to GDP, United States

Source: Wikipedia

U.S. GDP

Look at the history of the ratio of federal debt to gross domestic product as it evolved over time. The debt increased rapidly during the Civil War, the First World War, the Second World War, and less rapidly during the current wars in Iraq and Afghanistan. In the post war periods of the first three wars mentioned, the ratio was reduced. While the ratio is high by historical precedents, it is not unprecedented.

Note that the United States did not beat the depression until World War II, when there was a huge stimulus effect of the spending on the war.

Ratio of Federal Debt to GDP, United States

| Source: Wolfram Alpha |

The second graph shows the same data for just the more recent decades. Note that the debt to GDP ratio increased during the Reagan and Bush 1 administrations and during the Bush 2 administration, being cut during the Carter and Clinton administrations, but growing again due to the stimulus packages in the last few years.

U.S. Federal Debt

| Source: Wolfram Alpha |

| Source: Wolfram Alpha |

While surely the United States should work to bring down the ratio over the coming decades, it does not seem to be at crisis level now. As the graphs above show, bringing down the ratio historically depended on the growth of the economy. While the federal debt has grown over the years, there were long periods where the economy grew faster than the debt, making that debt more manageable.

No comments:

Post a Comment