There was an interesting article in The Economist a couple of weeks ago, reflecting new economic research on the distribution of income.

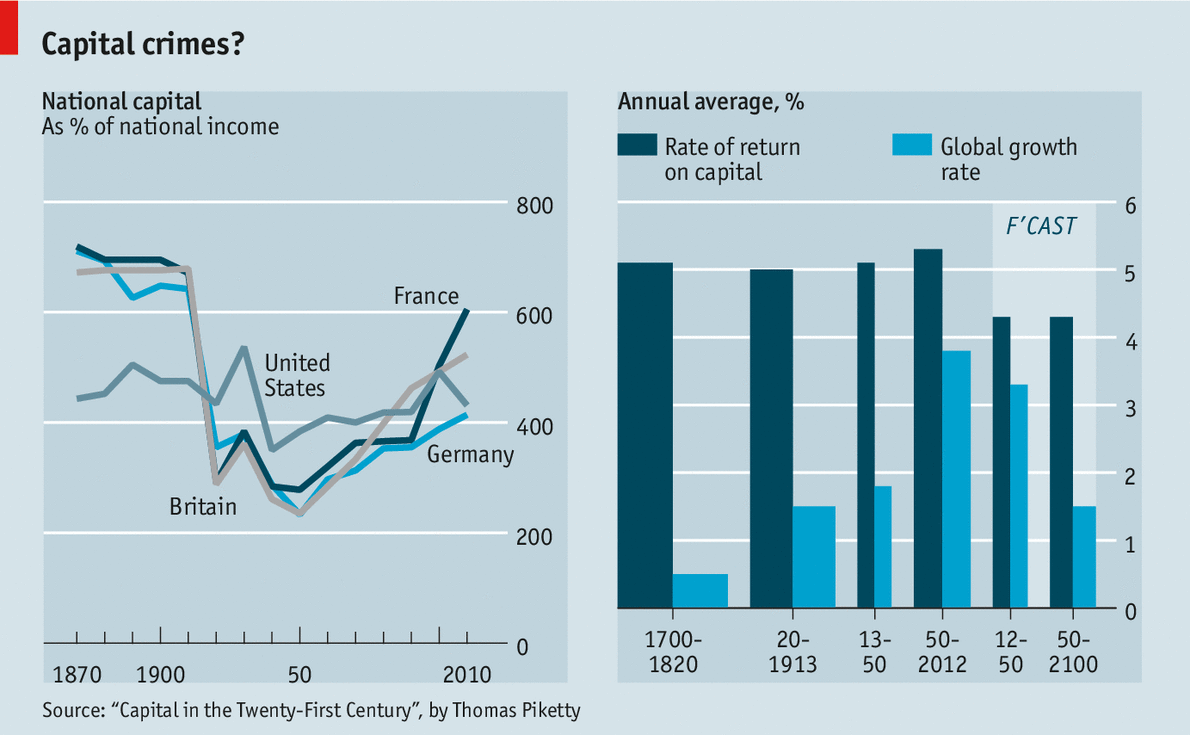

It suggests that when the saving rate is higher for a country than the economic growth rate, then the ration of national capital to GDP increases. As the graph on the left indicates, this has been happening in the USA, France, Germany and Britain more or less continuously since 1940.

The graph on the right indicates that the rate of return on capital has been relatively constant for centuries.

The implication should be obvious. If the ratio of capital to GDP is increasing, and if the rate of return to capital is constant, than more of the GDP will to return on capital; less will be available for return to labor.

In Mr Piketty’s narrative, rapid growth—from large productivity gains or a growing population—is a force for economic convergence. Prior wealth casts less of an economic and political shadow over the new income generated each year. And population growth is a critical component of economic growth, accounting for about half of average global GDP growth between 1700 and 2012. America’s breakneck population and GDP growth in the 19th century eroded the power of old fortunes while throwing up a steady supply of new ones.The article concludes:

New technology can also make it easier to substitute machines for human workers. That allows capital to gobble up a larger share of national income, raising its return. Amid a new burst of automation, wealth concentrations and inequality could reach unprecedented heights, putting a modern twist on a very 19th- century problem.Perhaps rapid growth of capital and slow growth of population leads to conditions that favor investment in the production of labor saving, capital intensive technology.

On the other hand, evolving technological systems have their own directions for technological development. The industrial revolution was based on engines (largely using fossil fuels) driving machinery, and these may have encouraged capital-intensive, labor saving technology development. The Information Revolution -- especially in the smart phone, Internet era -- may be promoting a different kind of technological innovation and thus a different economic trajectory.

1 comment:

"The 85 richest people on Earth have the same amount of wealth as the bottom half of the population, according to a new report that highlights growing income inequality as political and business leaders gather for the annual World Economic Forum in Davos, Switzerland.

"Those wealthy individuals are a small part of the richest 1% of the population, which combined owns about 46% of global wealth, according to the report from British humanitarian group Oxfam International."

http://www.latimes.com/business/money/la-fi-mo-oxfam-world-economic-forum-income-inequality-20140120,0,7080817.story#ixzz2qxkgwxLY

Post a Comment